|

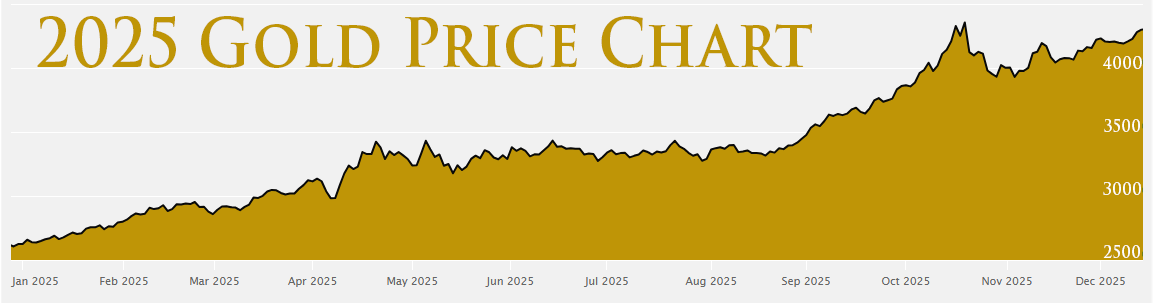

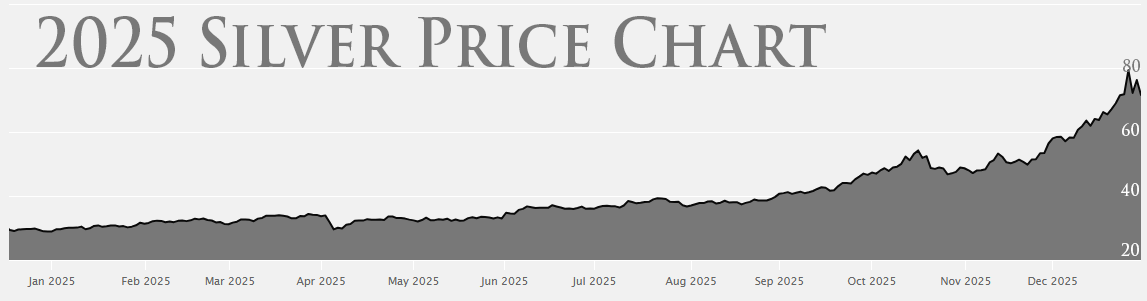

One factor we continue to watch closely is physical scarcity. At today’s prices, that represents a total above-ground value of gold just over $40 trillion. Silver, while more plentiful, remains limited in aggregate terms as well, representing a total value of approximately $4.5 trillion at today’s prices.

In the context of global wealth, financial markets, and ongoing currency creation, these figures are not particularly large. It does not take a significant shift in capital allocation to place meaningful pressure on physical supply. We are already seeing signs of this, including longer delivery times for certain physical silver products and tighter availability across parts of the market.

At the same time, investor behavior continues to evolve. We are seeing a steady shift away from paper exposure and toward physical ownership, as more investors prioritize tangible assets that exist outside traditional financial systems. Notably, large pools of capital have not yet fully moved into physical precious metals, but we are beginning to speak with a growing number of ultra-high-net-worth individuals who are entering the physical market for the first time.

As always, our team remains actively engaged in both buying and selling, and we are here to help you navigate these conditions thoughtfully and confidently. Whether you are considering adding to your holdings, taking profits, or simply want to discuss the market, we welcome the conversation. Call us at 800-928-6468.

Thank you again for being part of the Austin Rare Coins & Bullion family. We look forward to working with you throughout the year ahead.

Warm regards,

The Austin Rare Coins & Bullion Team

|