|

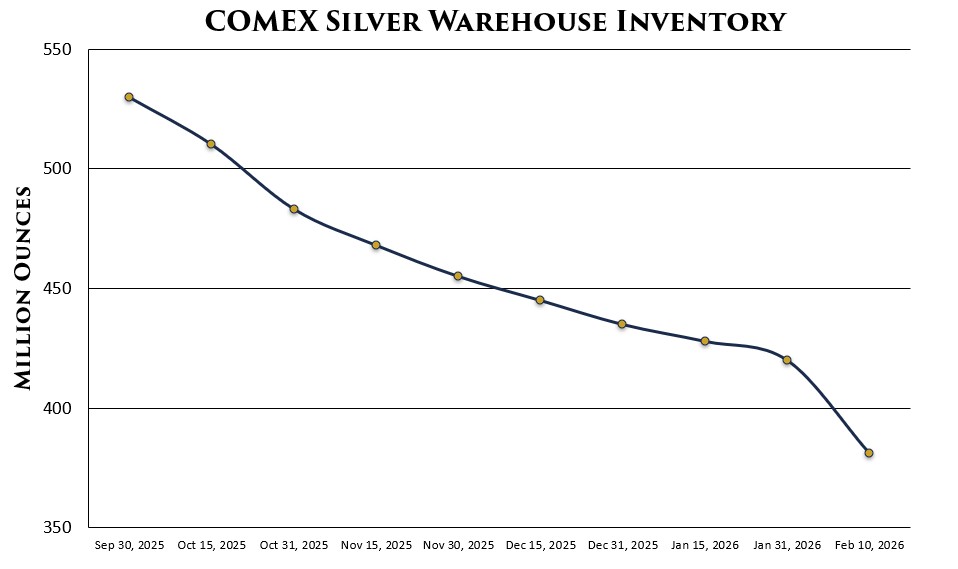

When inventory levels decline while demand remains firm, it naturally raises questions about sudden, volatile price corrections in paper markets.

Over the past month alone, we have worked with multiple clients who made the decision to convert paper silver and gold positions into tangible physical metal under their direct custody. Some transactions were as large as mid-seven figures. The consistent theme we’re hearing is simple: when markets become uncertain, many investors prefer to remove layers of counterparty exposure and hold their positions off the grid.

While paper products can provide price exposure, they also depend on systems, counterparties, clearing mechanisms, and contractual structures. In stable markets, those structures function smoothly. The real question is what happens when conditions change rapidly. In periods of financial stress, liquidity events, or delivery pressure, does a paper claim always behave the way investors expect? Is the metal truly there? That is a question more and more investors are quietly asking us.

Physical metal provides possession, control, and independence from financial intermediaries. It allows you to remove your wealth from the increasingly fragile financial system. That difference may not seem urgent in calm markets, but it can become very important in volatile ones.

This is not about alarmism. It is about prudence - understanding what you own, how you own it, and what risks you are willing to accept.

If you are considering turning paper promises into something tangible you can see, hold, and control, we are here to guide you through the process. Whether you are converting an existing position or beginning a new allocation, our team can walk you through availability, logistics, allocation, and timing.

Call us directly at (800) 928-6468 to discuss your goals. We appreciate your continued trust and look forward to serving you.

Warm regards,

The Austin Rare Coins & Bullion Team

|