The Silver Bull Market: Investing in the Other Gold

Click to enlarge

(Hardcover)

After outperforming virtually all other investment classes for more than a decade, gold is being reincorporated into the financial system as an asset deserving a position, large or small, in mainstream diversified portfolios. Leaving aside the metal's rediscovered diversification benefits (it tends to go in the opposite direction when stocks go down sharply), gold has risen as a viable investment alternative in today's environment of unhinged global government spending and monetary expansion.

While silver has risen as well—even more than its sister metal over the last decade—it has remained gold's shadow investment for important reasons. For one, its smaller market and higher volatility have kept most financial professionals away, as the metal is often regarded as a highly erratic investment best left to speculators. There is also the memory of the 1980s and '90s bear market, precipitated, in part, by the illegal attempt by two wealthy families to corner the silver market, which led to the metal's darkest day, March 27, 1980. While gold has more than doubled in value since its 1980 peak, silver remains substantially below the all-time high it reached more than three decades ago.

In The Silver Bull Market, Shayne McGuire examines the vital investment considerations about silver alongside the significant drivers of the metal's bull market. Although silver moves closely with gold in financial markets, it differs from its sister metal in that more than half of demand is derived from multiple industrial processes. While its significant reliance on film photography has ended, today silver's industrial demand is driven by technological progress (brazing alloys and solders, smart phones, tablets, plasma panels and new applications like silk-screened circuit paths and radio frequency ID tags); photovoltaics (solar panels); and new medical applications (silver is both biocidal and highly conductive). Though Warren Buffett disdains gold for its lack of utility, he regards silver differently: in the late 1990s, he purchased 130 million ounces, one-fifth of global production at the time.

Authenticity Guaranteed

Each item certified for authenticity

Fast Shipping

Secure and insured delivery

Secure Payment

Safe and encrypted transactions

35+ Years in Business

Trusted since 1989

BBB Accredited

A+ Rating with Better Business Bureau

You Might Also Like

Available

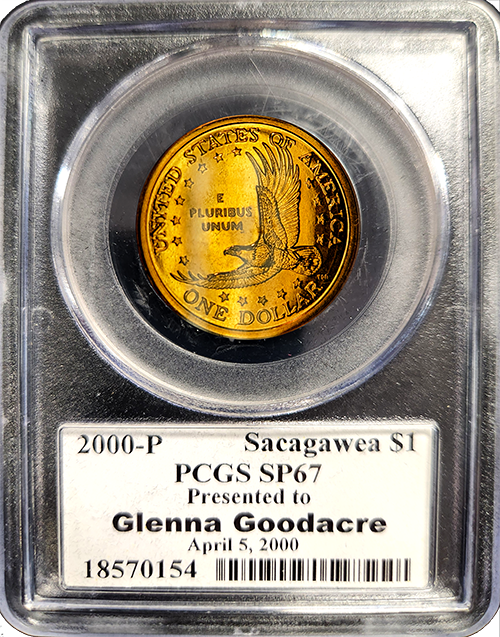

2000 Sacagawea PCGS 1 Dollar SP-67

Lowest Price

$606.38

Available

2014 Royal Mint Executive Premium Collector 14-Coin Proof Set

Lowest Price

$250.25

Available

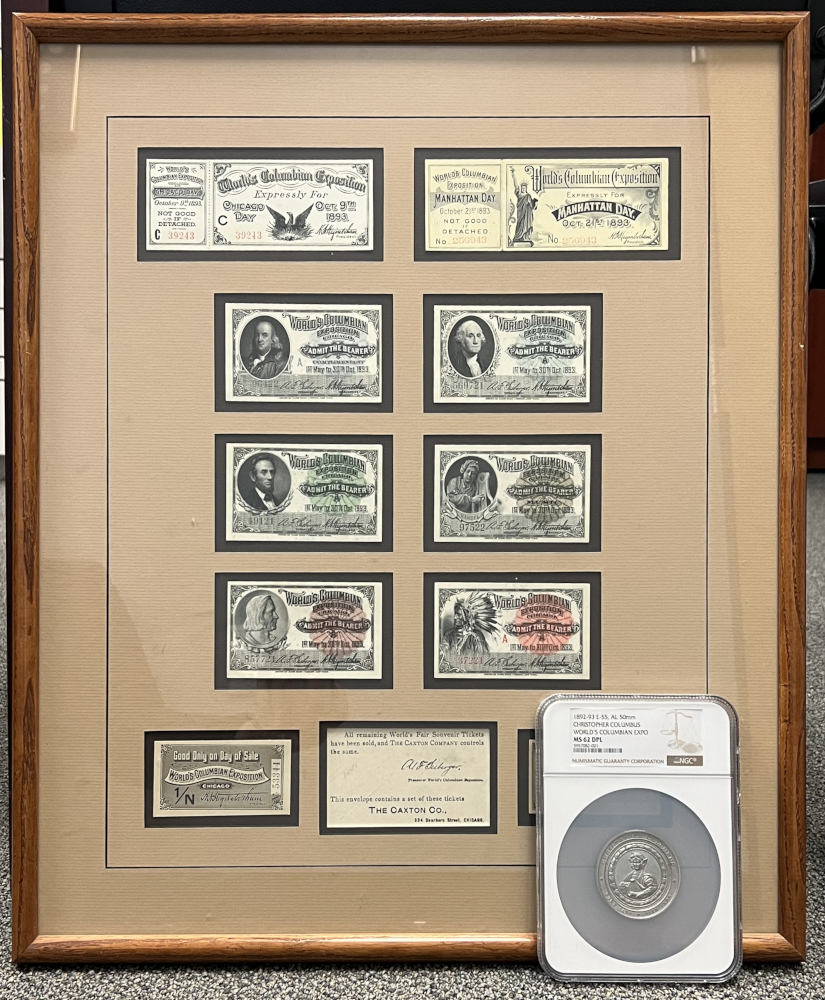

1892-93 World's Columbian Exposition 50mm Medal NGC MS-62 DPL w/ Ticket Collection and Envelope in Framed Display

Lowest Price

$1,631.44

Available

100 Greatest Ancient Coins

Lowest Price

$63.53